My Fundrise Investment – Two Years Later (2019 Update)

Two years ago, I put together a blog post and video explaining how Fundrise works.

Quick Recap: Fundrise is a real estate crowdfunding platform that allows people to invest smaller amounts of money (as little as $500) into eREITs. Essentially, it's like buying into a “pool of real estate”, rather than tying up all of your investment dollars in one single property.

Back in 2017, I decided to invest $1,000 of my own money into the site while also recording the process and showing people how it worked.

You can see the original video here.

After posting that video, some of the more common questions I heard from people were,

What have your earnings been to date?

How has your account performed?

How much money have you made since investing?

I thought these were all valid questions, so I put together a one-year follow up video to show people how the results turned out.

You can see that blog post and video here.

Of course, the performance of my investment doesn't necessarily dictate what YOUR returns may look like (because every eREIT performs differently) – but it does offer some insights on how Fundrise performs as a company – specifically in comparison with other investment options like the stock market, mutual funds, or some of the other real estate crowdfunding websites out there.

RELATED: Today's Top Real Estate Crowdfunding Websites

So – for what it's worth, I just put together ANOTHER follow-up video to show what my returns have been, now that Fundrise has been working with my money for 24 months. IYou can see it here…

Disclaimer: The information contained herein neither constitutes an offer for nor a solicitation of interest in any securities offering; however, if an indication of interest is provided, it may be withdrawn or revoked, without obligation or commitment of any kind prior to being accepted following the qualification or effectiveness of the applicable offering document, and any offer, solicitation or sale of any securities will be made only by means of an offering circular, private placement memorandum, or prospectus. No money or other consideration is hereby being solicited, and will not be accepted without such potential investor having been provided the applicable offering document. Joining the Fundrise Platform neither constitutes an indication of interest in any offering nor involves any obligation or commitment of any kind. The publicly filed offering circulars of the issuers sponsored by Rise Companies Corp., not all of which may be currently qualified by the Securities and Exchange Commission, may be found at www.fundrise.com/oc.

We’re into real estate investing. We're also into keeping it real.

Some of the links in this article help to financially support this website, but the real-world guidance is all REtipster.

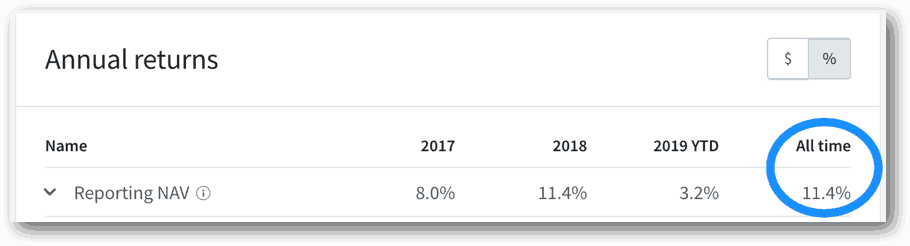

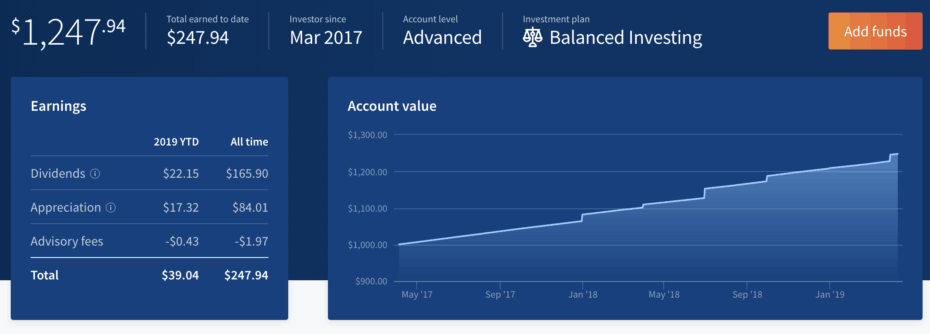

As you can see – my original $1,000 investment (with all dividends automatically reinvested) have earned a pretty steady 11.4% over the past year, and it has average the same amount since I first invested the money.

This screen shot above was taken on April 11, 2019 – just a day after receiving my Q1 dividend for the year.

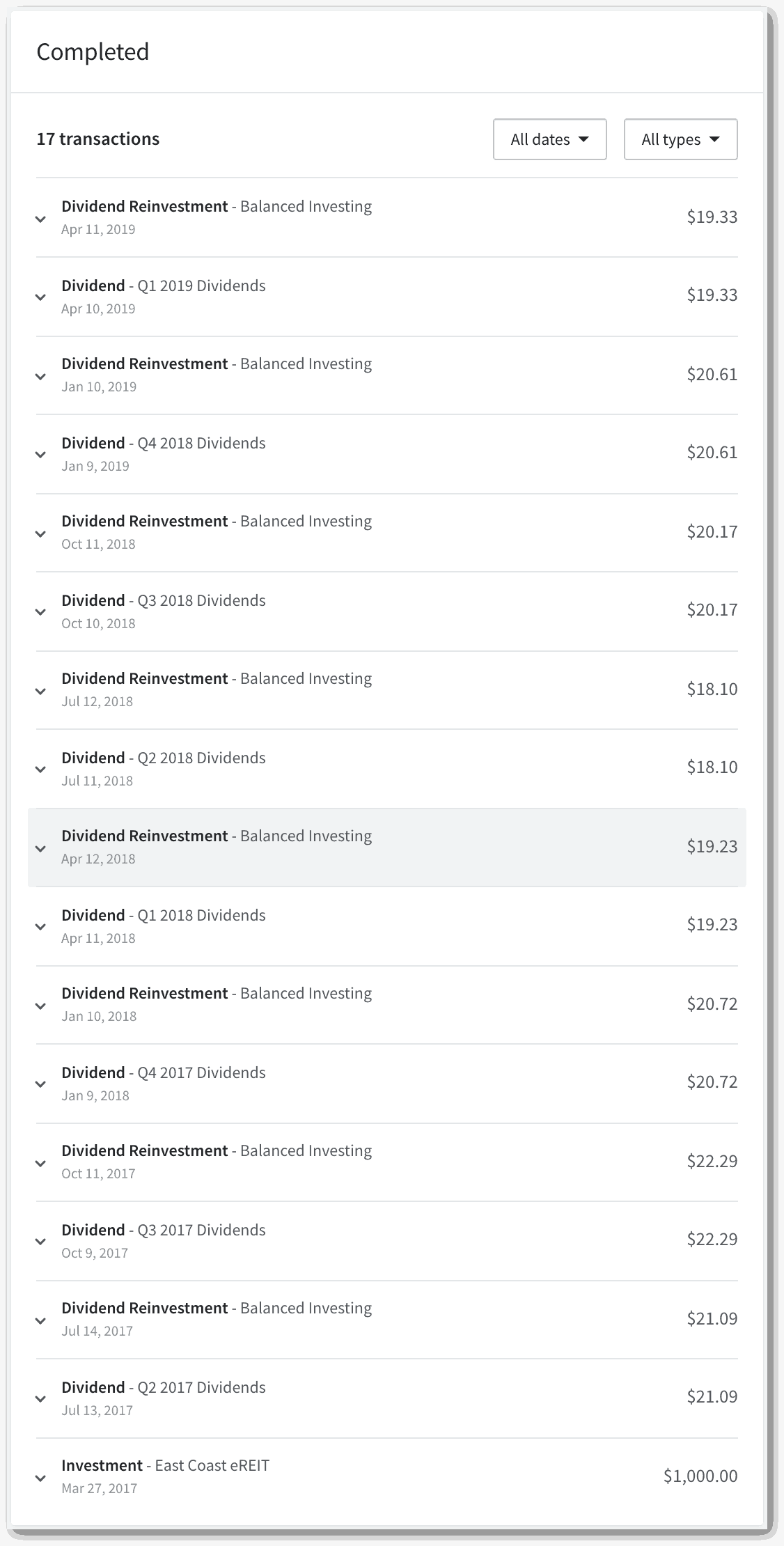

Here's a quick snapshot of EVERY dividend I've received since I got started 2 years ago:

When I first set this up 2 years ago, I told Fundrise to automatically reinvest all of my dividends (rather than sending them to my bank account), which is why the portfolio value has grown like it has (rather than just staying at $1,000).

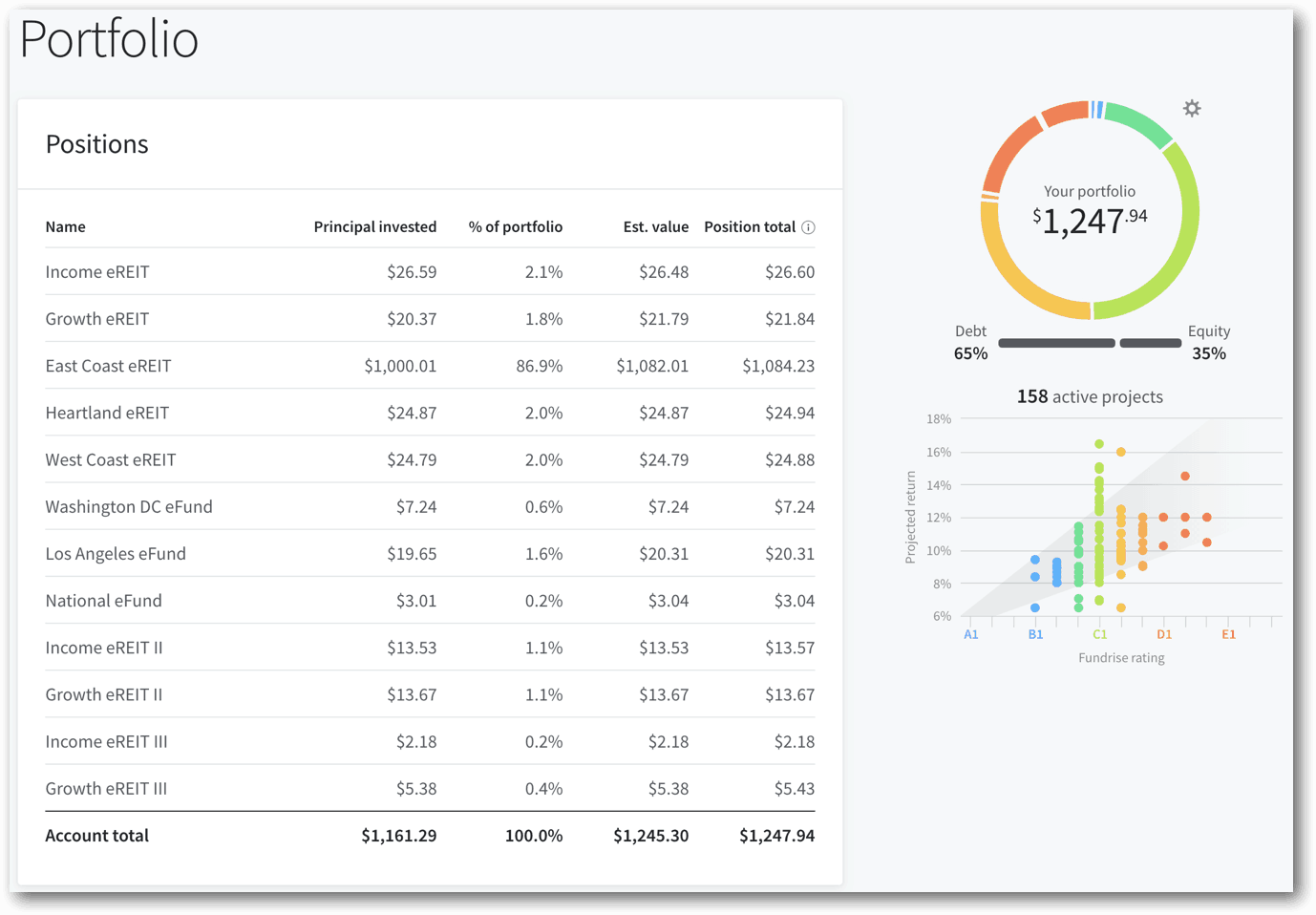

After looking at my portfolio positions, I did find it interesting that even though I originally chose to invest in the East Coast eREIT, my dividends had been invested in other eREITS. Fundrise presumably reinvested these dividends into other eREITs because the East Coast eREIT met its fundraising goals and wasn't taking any more contributions.

In any event, it doesn't seem to have hurt the performance at all.

Now, I know what you're thinking – 11.4% isn't a staggeringly high return. One could certainly do better by going through the work of finding, analyzing, buying, improving and selling a property on their own… but on the same coin, doing everything yourself takes a lot more time, energy and effort. It's definitely NOT passive to do it all one your own.

The returns I've earned with Fundrise have required virtually nothing from me, aside from the 5 minutes I spent deciding which eREIT to invest in, and the inherent risk that the returns might not pan out according to plan.

Another important point worth noting is that my $1,000 principal investment with Fundrise is basically tied up for 5 years (give or take), so the earliest I'll be able to get my money back is about 3 years from now.

I also don't have any control over which properties are included in the eREIT funds I'm invested in, how those properties are managed when they're sold off, etc. I'm putting a lot of trust in the folks at Fundrise to manage my money with prudence. So far, it looks like they're doing a good job – but only time will tell if it remains this way over the next 5+ years.

Have you invested your money with any real estate crowdfunding companies? How have your investment dollars performed? Let us know in the comments below!

The post My Fundrise Investment – Two Years Later (2019 Update) appeared first on REtipster.

from RSSMix.com Mix ID 8230708 http://bit.ly/2ILivWO

via IFTTT

Comments

Post a Comment